NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Warby Parker—a Digitally Native Vertical Brand (DNVB) specializing in eyewear—has visions of an IPO. Warby Parker is known for its at-home try-ons and its “buy a pair, give a pair” initiative. The DTC company started in ecommerce and later became omnichannel, with a network of stores throughout the U.S. Consumer transaction data shows how sales have grown at Warby Parker during the pandemic, as well as how the company stacks up against other eyewear competitors.

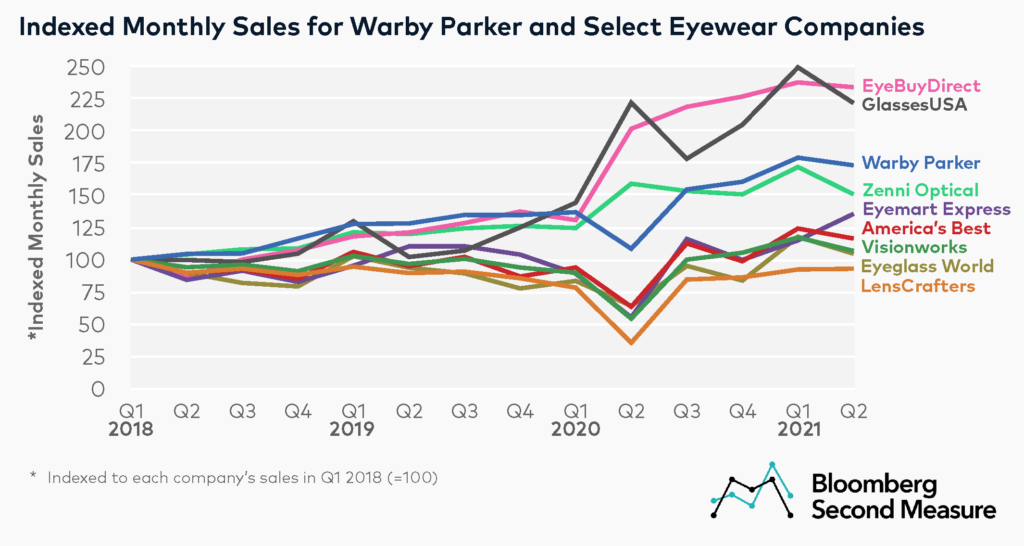

In the eyewear industry, Warby Parker and online-only companies have seen the most growth during the pandemic

Warby Parker is a newer entrant to the eyewear industry, competing with a range of omnichannel and online-only companies. Warby Parker’s offerings include eyeglasses, sunglasses, contact lenses, and eye exams. Other omnichannel competitors with the same types of products and services include LensCrafters, Eyeglass World, Eyemart Express, Visionworks, and America’s Best. However, Warby Parker is differentiating itself by expanding into telehealth with the launch of a new app for virtual eye exams and vision prescription renewals. EyeBuyDirect, Zenni Optical, and GlassesUSA are online-only companies that specialize in eyeglasses and sunglasses.

Among the eyewear competitors in our analysis, online-only companies have fared better than omnichannel companies during the pandemic. More specifically, omnichannel competitors such as LensCrafters and Eyeglass World experienced sharp declines in sales in Q2 2020, while the online-only companies—especially EyeBuyDirect and GlassesUSA—saw significant sales growth.

Between the first and second quarters of 2020, Warby Parker and other omnichannel companies saw a decline in sales, likely driven by the temporary closure of retail locations when shelter-in-place orders went into effect. Warby Parker’s sales declined 21 percent in Q2 2020. However, the company’s quarterly sales have since rebounded and exceeded pre-pandemic levels. In Q2 2021, Warby Parker’s sales were 60 percent higher than in Q2 2020 and 35 percent higher than in Q2 2019.

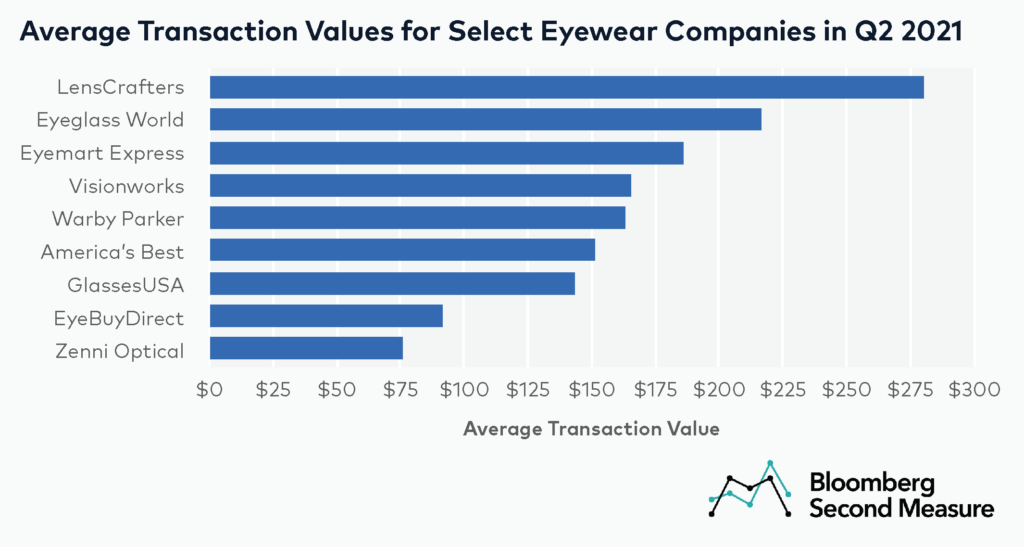

Warby Parker’s average transaction value is lower than that of traditional eyewear retailers, but higher than that of online-only competitors

In Q2 2021, Warby Parker’s average transaction value was $163, roughly in the middle of the pack when compared to established retail eyewear companies and online-only companies. LensCrafters had the highest average transaction value in this time period, with $280. The lowest was online-only brand Zenni Optical, with $75.

A possible factor contributing to the lower transaction values for the online-only competitors is that they do not offer eye exams—unlike the competitors that have a retail presence—and most also do not offer contact lenses. Another factor that may influence average transaction values is vision insurance; each company accepts different insurance plans, which may affect out-of-pocket costs.

Product offerings for eyeglasses themselves also differ, thereby affecting prices. Warby Parker’s eyeglasses are all from its in-house brand and have more standardized prices and add-ons, while companies like LensCrafters offer multiple brands, including designer brands, at more varied price points.

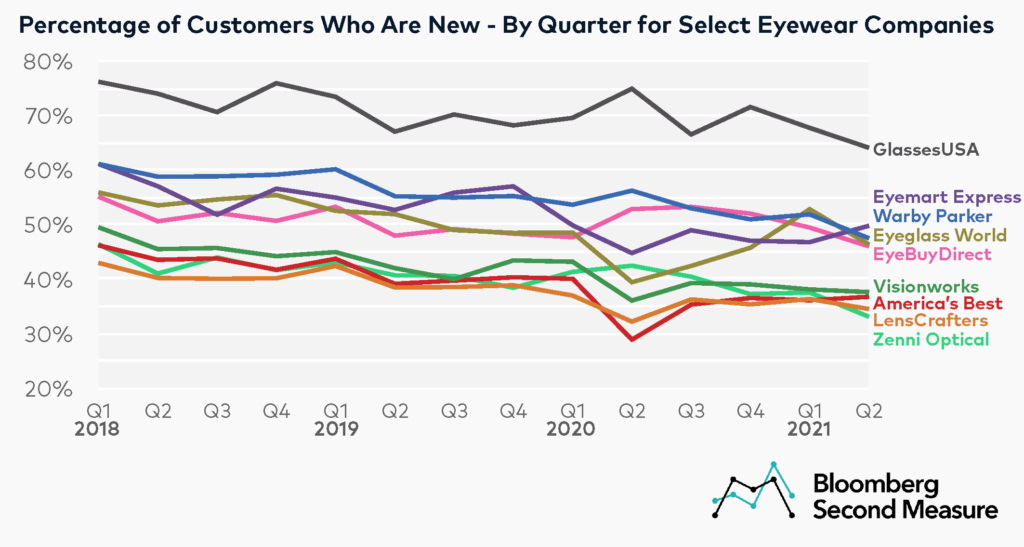

Roughly half of Warby Parker’s customers each quarter are new

Much of Warby Parker’s growth is also fueled by new customers, especially when compared to other eyewear companies. In Q2 2021, 47 percent of Warby Parker’s customers were new. Interestingly, prior to Q2 2021, more than half of Warby Parker’s quarterly customers were new. EyeBuyDirect and Eyeglass World had a similar percentage of new customers as Warby Parker in Q2 2021, with 46 percent each.

Among these eyewear companies, Zenni Optical and LensCrafters had the smallest percentage of new customers in Q2 2021, with 33 percent and 35 percent, respectively. GlassesUSA had the largest, with 64 percent.

Between Q1 and Q2 2020, the online-only competitors experienced a bump in their percentage of new customers while most of the omnichannel companies experienced a dip. EyeBuyDirect and GlassesUSA each saw a 5 percentage point increase in their share of new customers, while the share of new customers at Eyeglass World and America’s Best declined 9 percentage points and 11 percentage points, respectively. For Warby Parker, the share of new customers increased 3 percentage points during this time.

IPOs for socially conscious companies are on the rise

Warby Parker joins other mission-driven, sustainability-focused companies—including Allbirds, Rent the Runway, and Sweetgreen—in this fall’s upcoming series of IPOs. This IPO lineup corresponds with an increased focus on environmental, social and governance (ESG) funds. Warby Parker plans to go public via direct listing rather than a traditional IPO, listing shares under the ticker WRBY.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.